Maximizing lease-up to maximize fees in the HCV program: Part I

In these times of reduced budgets, it's more important than ever to understand our funding, learn how to maximize our earnings, and share ideas on how we can do more with less. Follow our four-part series on HCV administrative fees.

Part II: Why it's so important to manage our leasing to voucher allocations

Part III: What agencies can do to better lease to voucher allocations

Part IV: Streamlining operations to reduce the strain on admin fees

How did we get here? A brief history of changes in admin fee allocations, and how circumstances created the "perfect storm" for housing authorities

HCV administrative fees are used to pay for the administrative expenses of running the HCV program. This includes salaries, rents or mortgages, insurance, etc. Obviously, without administrative fees, PHAs cannot effectively run an HCV program.

For years, agencies earned admin fees based on the number of units under lease as of the first of each month. Agencies understood the importance of this revenue stream and managers aggressively managed to ensure maximizing the fees earned. PHAs leased up as much as possible to voucher allocations, and kept a sharp eye out for operational obstacles that delayed timely leasing.

In 2004, everything changed. Congress awarded funding, and directed HUD to allocate administrative fees, on a pro-rata basis — that is, based on the fees agencies were eligible to receive in Federal Fiscal Year 2003. This resulted in agencies receiving healthy admin fees regardless of lease-up or voucher utilization.

In 2004, everything changed. Congress awarded funding, and directed HUD to allocate administrative fees, on a pro-rata basis — that is, based on the fees agencies were eligible to receive in Federal Fiscal Year 2003. This resulted in agencies receiving healthy admin fees regardless of lease-up or voucher utilization.

The SEMAP (Section 8 Management Assessment Program) Lease-Up Indicator remained a consideration. But under this indicator, PHAs can score the maximum 20 possible points if they either lease up at least 98% of allocated vouchers, or expend at least 98% of HAP funding. PHAs can score 15 points if they lease up at least 95% of allocated vouchers, or expend at least 95% of HAP funding.

The 2004 change "freed" agencies from managing lease-up based on voucher allocations. This meant they were able to give more weight to other factors in decision making, including the impact of a federal economic crisis on the local community. As a result, many — if not most — agencies managed lease-up to HAP expenditures, meaning they were spending more in HAP on fewer families.

This set the stage for the "perfect storm."

This set the stage for the "perfect storm."

In 2008, without great fanfare, the rules changed once again. PHAs were back to earning admin fees based on units under lease as of the first of the month. Although agencies that managed lease-up to HAP expenditures were poorly positioned for this change, most agencies did not initially feel the negative impact, because federal allocations continued to rise. Many agencies continued to under-lease units but receive 15 or 20 SEMAP points based on HAP expenditures.

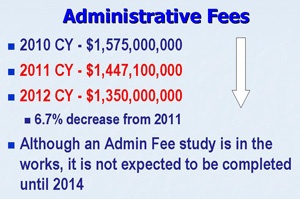

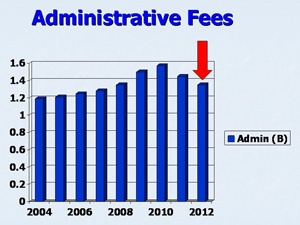

In 2011, Congress reduced administrative fee funding and agencies found themselves caught in the storm. Admin fees were reduced even more in 2012.

Administrative Fee Funding

2008 CY — $1,351,000,000

2009 CY — $1,500,000,000

2010 CY — $1,575,000,000

2011 CY — $1,447,100,000

2012 CY — $1,350,000,000

As we were preparing to post this article to the blog, PIH 2012-15 was released. It touches on some of the solutions we will be discussing here.

NMA senior consultant Teri Robertson is nationally recognized as a leading expert in HCV and public housing rent calculation, including HUD RIM review requirements. She specializes in helping agencies improve program utilization to maximize funding.